Tag Archives for " Carlsbad CA Homes for Sale "

For some people, living by the sea is an absolute dream. Many individuals travel to the ocean side to travel, unwind on the sand, and pay attention to the waves. With this in mind, you might ask if buying a house in Carlsbad is a good idea.

One who would buy a home in Carlsbad should expect a low crime rate. Living in Carlsbad even offers a relaxing atmosphere but at an expensive cost. Aside from the beaches, it is also rich in golf parks, flower fields, and villages.

With these reasons and factors, should people invest in buying a home in Carlsbad? Read on.

People are happier and fitter in Carlsbad than in any place.

For quite a long time, specialists have prescribed the shore to cure some illnesses. Present situations show those living close to the sea partake in the advantages to their well-being.

The ocean side is connected with unwinding. It’s also connected with sea tides, ocean breezes, and warm sand. All these assist in eliminating the pressure of day-to-day existence. A get-away at the ocean side can somehow diminish your feelings of anxiety. Still, those living close to the seaside of Carlsbad can encounter this same advantage consistently.

People living close to the sea have been viewed as more settled and experience less agony. Moreover, living close to the sea likewise empowers actual work. Strolls on the sand, swimming, surfing and ocean-side volleyball are astounding activities.

These activities can help develop heart well-being and diminish cholesterol levels. Living near the sea urges individuals to get out and partake in the salt air and daylight. It remains dynamic and gives the medical advantages of everyday work-out.

There is no doubt that Carlsbad is a good investment. It is a place suitable for business where any investment should be profitable. It only means it can turn into a business or, if not, at least make its worth as valuable as its price.

The ocean side encounters all seasons. Setting up a business is essential in setting costs throughout the spring and summer. Without planning, people could battle to cover the cold weather months when customers are lower. This isn’t generally the situation, but it does not snow in Carlsbad!

It’s likewise essential to note that travel patterns have changed due to the pandemic. With the families consistently searching for a difference in view, feeling a new vibe is one factor. This implies that ocean-side rentals are getting booked yearly, no matter the climate.

Depending on the owner’s terms, any home can be up for rent. So if they get tired of the view, which happens rarely, they can always take a vacation anywhere.

Since ocean-side rentals are inclined to more harm, renters should pay higher protection charges for the property. Moreover, having a pleasant property close to the sea makes advertising more straightforward. That is to say, who could do without watching Instagram accounts of individuals having a cookout at the ocean side or seeing submerged pictures?

Many would suggest doing professional photography. While it’s true, being close to the sea gives people an incredible benefit in advancing your rental.

It is quite expensive to live in Carlsbad, CA. It is in the city with many enjoyable places, so it is only natural for it to be expensive.

If a person wants to move to Carlsbad, they need to understand the cost of most everyday items! Generally speaking, the Cost of Living in Carlsbad is expensive. This place is beautiful, which may lead to its expensiveness.

It gets a score of 70 percent higher than the national average. What is pushing up the expense to such an extent? It is the expense of lodging.

The middle home expense in Carlsbad, CA, is an incredible $875,000. That is a whopping high for California, as the state normal is $553,000. Contrasted with the public normal of $231,000, however, Carlsbad is up in the stratosphere, lodging-wise.

In contrast, it has affordable pharmacies and utilities. It should be as keeping the lights on and the AC blowing cool is fundamental when you live on the California coast. In Carlsbad, however, there are no boiling days here or, so far as that is concerned, freezing days by the same token.

The typical medical care cost for most everyday items in Carlsbad is a critical variable for some families here. That is particularly evident if, for instance, for little kids and adults. Regardless of family circumstances, medical services costs in Carlsbad, CA, are reasonable.

Here are the nine tips people should consider if they want to move to Carlsbad, CA

Take note of the costing and expenses. People are only encouraged to buy if they have what it takes to stay there. Many might have business as a reason to move. Still, they will always need money for the establishment and other things.

Save for a down payment. Homebuyers will have to skip this if they plan to pay in better cash!

Save for closing costs. Closing costs talk about the payment homebuyers need to pay. They give this payment to their attorneys, inspection fee, and title insurance payment once everything is set.

Select the type of homes you want. Carlsbad is not all about beaches. They have middle houses and townhouses too.

Check pre-beach homes. The former people built some houses at Carlsbad in the 1960s. With this, the foundation of these homes has deteriorated over time.

Resort to a safer place. Buyers might push through if they can manage the 32 Crime Rate, which is safer than 32% of the U.S. Cities.

Remember that Carlsbad is for sunshine lovers. The sun is present at Carlsbad for 270 days a year, perfect for outdoor lovers!

Consider specific home features. If homebuyers don’t have their additional features yet, this could call for extra expenses. If they want to retain things, that would not be a problem, though.

Stick to your budget. Don’t loan money for unnecessary expenditures.

In general, Carlsbad is an ideal place to live with friends and family. The following tips and information could make any homebuyers informed about Carlsbad. It is a good place, but it is not for everybody, especially those that cannot afford them.

If you need help with buying a Carlsbad home, get in touch with the best realtor in the area, Dennis Smith.

If you’re thinking of buying a home in Carlsbad, CA, you probably already know just how tight the competition is. Since the start of the coronavirus pandemic, Carlsbad housing prices have gone up 36.1 percent!

While purchasing and owning your first home can be intimidating, you should know that it’s an attainable goal. With the help of tax breaks and first-time homebuyers programs offered by the federal and California state governments, that goal is more attainable than ever!

To qualify as a first-time homebuyer in Carlsbad, CA, you must prove adequate income, good credit rating, obtain a mortgage, and provide a minimum down payment of 3 percent.

To help you out, let’s discuss all the basics of first-time homebuyer requirements in San Diego, California. Before we do that, though, let’s clarify what it means to be a first-time homebuyer.

Let’s get started!

You might be surprised to find out that “first-time home buyer” isn’t as restrictive as you think.

Generally, a first-time homebuyer extends to people who have already bought a home in the past. The catch is that the person should not have owned a home in the past three years to be considered a first-time buyer.

To qualify as a first time home buyer in Carlsbad, CA, you must fulfill these requirements:

Individuals who have owned a principal residence for three years cannot be considered first-time homebuyers.

Aside from having not owned or co-owned a residence in the past three years, you will also need to qualify for a mortgage to be a first-time homebuyer.

A lender will require you to meet a minimum credit score and a maximum debt-to-income ratio to qualify for a mortgage. You will also need to prove financial stability with your monthly income, cash reserves, and employment status.

How much your housing budget is will depend on several factors. Hence, you must determine a price range for your future Carlsbad home before you look for a home and apply for a mortgage.

The median home price for a home in Carlsbad has risen to $1.3 million, which is more than the average buyer can afford in San Diego.

To figure out if buying a home in Carlsbad is right for you and your budget, you should consider:

After figuring out the state of your finances, you can then figure out how much mortgage you can afford.

Thankfully, first-time homebuyers have many options when it comes to purchasing a home. These include Federal Housing Authority loans and programs that specifically target first-time buyers.

Many first-time buyer loans offer a minimum down payment of as low as 3 percent, opening a world of opportunity to buyers who have only come across the standard 20 percent down payment.

If you qualify as a first-time homebuyer, make sure to look into these mortgage options.

Before I introduce you to some of these loans, remember that qualifying will still depend on the lender (more on that later!):

Before qualifying for mortgage loans, you must determine exactly how much mortgage you are eligible for.

You might have set your eye on a home, but lenders may only be willing to give you a portion of that based on your debt-to-income ratio, monthly income, and current employment status. Lenders will also take into account loan factors:

A general rule of thumb is that lenders estimate mortgage payment affordability (interest, taxes, principal, insurance) to be 28 percent or less than the borrower’s gross monthly income.

In many cases, you won’t be entertained by sellers and even real estate agents if you haven’t been pre-approved for a mortgage.

Generally, Carlsbad, CA homes for sale get 5+ offers and sell in about 12 days. Since competition for Carlsbad homes is high, getting approvals from multiple lenders will show your buyer how financially secure and prepared you are to purchase a home.

Your real estate agent can give you a list of recommendations, or you can consider the options on Bankrate or Zillow.

You will need to provide the paperwork to show your financial stability, including:

Lenders will determine if you are qualified for their loan options based on these factors:

A qualified San Diego real estate agent can help you find a home that meets our needs and budget requirements.

Call me, Dennis Smith of San Diego Senior Real Estate, at 760-212-8225 to assist you in the entire buying process. From negotiating an offer to getting a loan and completing paperwork, I will be happy to be part of your journey in purchasing your first home.

for more information on home buying, click here:https://carlsbadhomesforsalenow.com/wp-admin/post.php?post=58470&action=architect&tve=true

Learn more about what people say about Dennis Smith: https://carlsbadhomesforsalenow.com/testimonials/

With the pandemic not being totally over and Thanksgiving nearing, showing your gratitude to people you love might not be as easy as usual. When you’re used to personally saying and expressing your appreciation, you may have a hard time thinking of ways to do so in these different times.

Luckily, there are still plenty of ways to show gratitude virtually. If you won’t be able to see your family and friends in person, the good news is the digital world has you covered!

Here are some of the heartfelt virtual gestures that can make a big impact:

For more information or assistance in buying, selling, or investing in real estate, please call me, Dennis Smith at 760-212-8225. I’ll be glad to take care of your real estate concerns in a way that’s healthy and safe.

This holiday season is the best time to show friends and family how much you love them, and I’m here to help you with your own gratitude campaign!

From writing short yet heartfelt letters to simply reconnecting with special people in your life, the range of ways to show gratitude are countless. No matter how big or small the gift, an act of thankfulness can change someone’s life.

Here are a few things you can do to show your loved ones how much you appreciate them:

For more information or assistance in buying, selling, or investing in real estate, please call me, Dennis Smith at 760-212-8225. I’ll be glad to take care of your real estate concerns in a way that’s healthy and safe.

Estate planning is a way to take care of your loved ones even when you can no longer do it. It’s simply making sure your hard-earned assets will be distributed in the manner you wish.

If you have a nice property, like a beautiful Carlsbad, CA home for example, you wouldn’t want it to go to unintended beneficiaries. You also wouldn’t want to add additional burden to the people you left behind. These can all be avoided by working on an estate plan as soon as you can.

If you haven’t incorporated an estate plan into your overall financial plan yet, consider the following benefits:

Please call Dennis Smith at 760-212-8225 for more information or assistance in buying, selling, or investing in real estate.

A good credit score is used for more than just getting a credit card. Your credit standing can affect almost all aspects of your life, including the quality of where you live.

If you’re planning to buy a home in Carlsbad CA, great credit will work in your favor. Your credit score is your assurance to lenders that you won’t default on your mortgage. Landlords also check your financial responsibility to decide whether to rent to you. An excellent credit guarantees owners that you can pay.

Those are just a few perks that maintaining good credit can bring. Read on to know what other advantages await you and learn how to build excellent credit too.

Please call Dennis Smith at 760-212-8225 for more information or assistance in buying, selling, or investing in real estate.

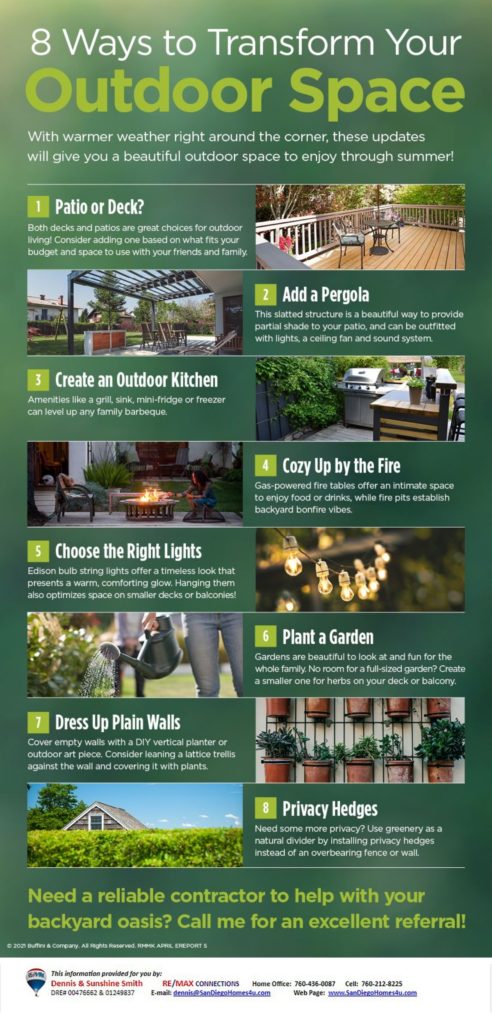

With the warmer weather quickly approaching, more and more people are thinking of being able to comfortably invite loved ones around to enjoy their outdoor space. Or perhaps you simply want a beautiful space where you can kick back and relax in the comfort of your Carlsbad CA home.

You don’t have to worry if your outdoor space is looking a little dull and uninspiring. With a few key changes that will add function and style, you can look forward to wonderful days and nights spent in your outdoor space!

Here are helpful tips to turn your outdoor space into a paradise:

Please call Dennis Smith at 760-212-8225 for more information or assistance in buying, selling, or investing in real estate.

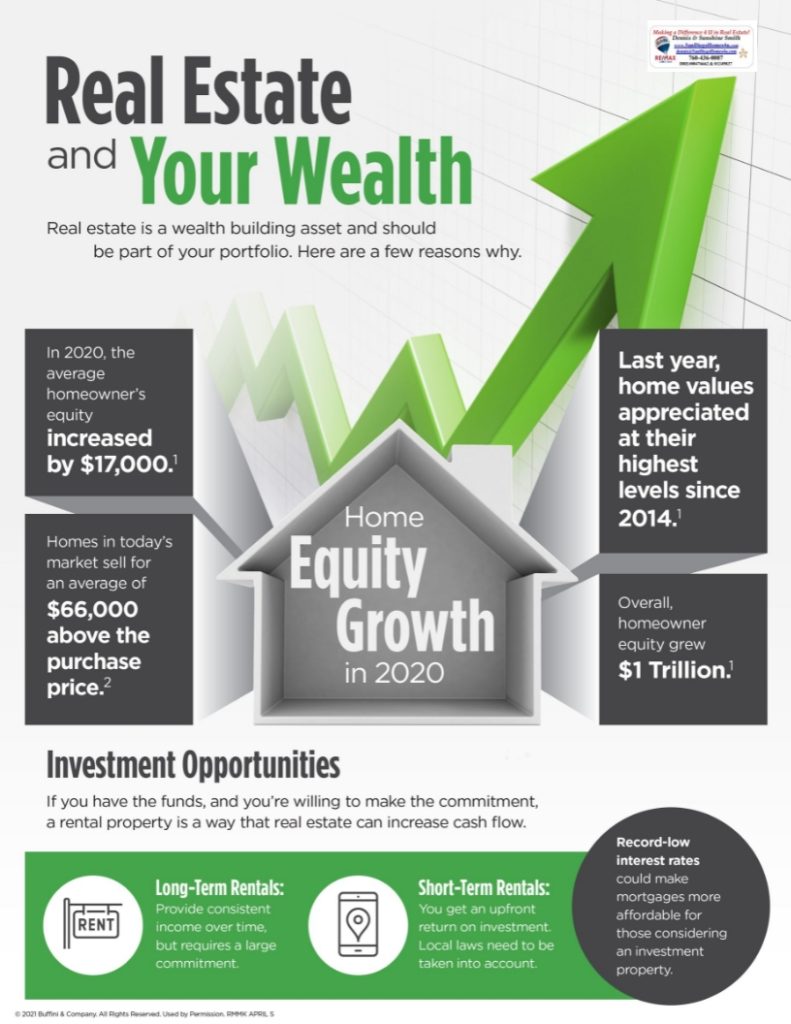

Real estate has long been considered a great investment. In fact, there are many benefits to investing in real estate.

With well-chosen assets, real estate can offer predictable cash flow. It also appreciates in value and provides a higher return because of positive leverage. If you are a real estate investor, you can also take advantage of the many tax breaks and deductions.

And if you’re thinking of selling one of your Carlsbad CA real estate, the spring is the perfect time to do so. Buyer demand is strong right now, and buyers are active in the market. Read on for more information.

Please call Dennis Smith at 760-212-8225 for more information or assistance in buying, selling, or investing in real estate.

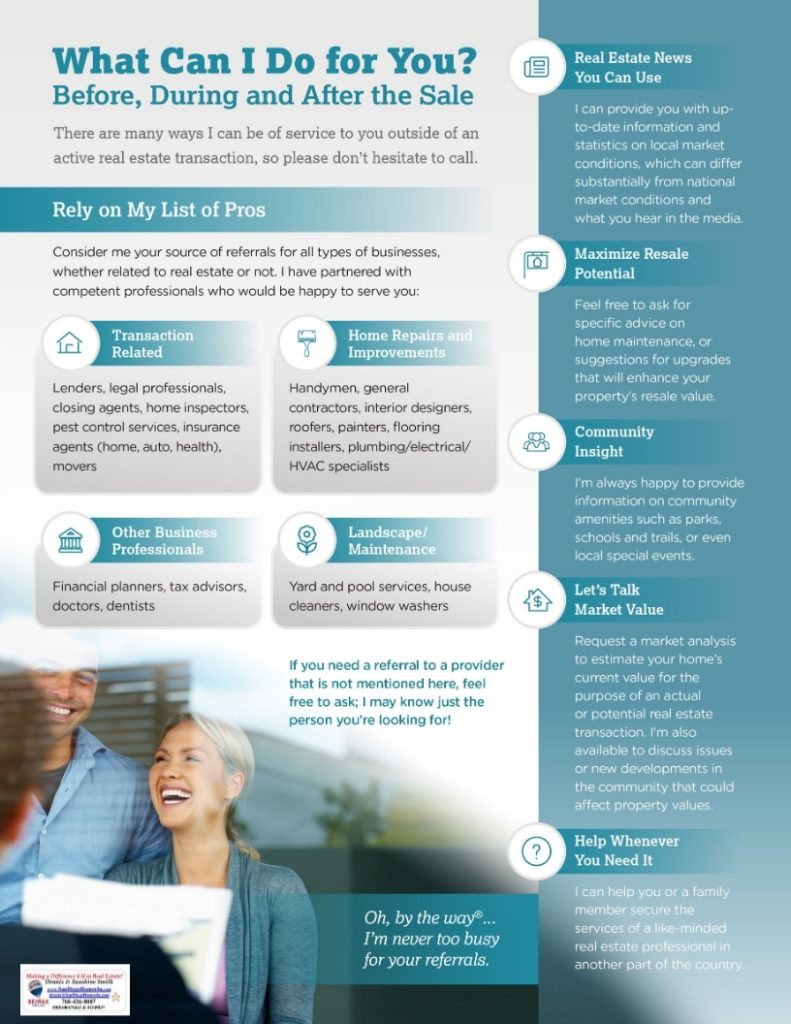

For most people, buying a Carlsbad CA home is one of the biggest financial transactions they will ever make. That is why working with the best real estate agent is essential in getting the best deal.

One of the most common ways to find a real estate professional is by word-of-mouth referrals. Trusted referrals from your family or friends are a powerful tool for finding the right real estate agent. Having someone refer you to an agent they had a positive, successful experience with is extremely helpful.

As an agent, there’s no greater compliment than a referral from a previous client. That’s why I work by referral.

Here are some benefits of working with me as your Carlsbad CA real estate agent:

Please call Dennis Smith at 760-212-8225 for more information or assistance in buying, selling, or investing in real estate.

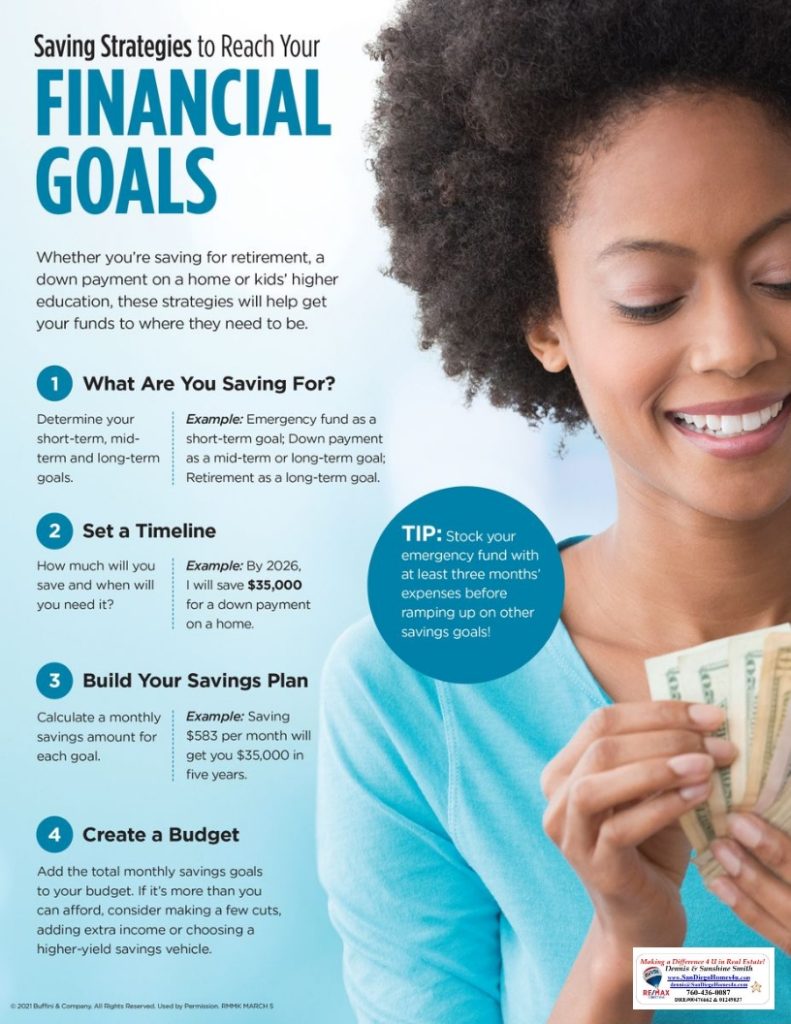

The value of saving money has seldom been disputed. In fact, it is considered the foundation of all financial success and is one of the most repeated financial advice one would hear.

However, despite its importance, many still find it difficult to save money. This is not surprising since it really requires discipline. But saving money is worth all the effort. It is completely possible. You can take control of your finances and your life.

Here are a few tips and savings tools that will help you reach your financial goals.

Please call Dennis Smith at 760-212-8225 for more information or assistance in buying, selling, or investing in real estate.