Spring is a season of blooming flowers, and it can be a great time for home improvements too. But with the many projects available for you to do, which would be the best one to tackle?

If you're excited to get your Carlsbad CA home a new look, check out these simple yet amazing projects below. Let's make your home ready just in time for summer!

If you have questions regarding buying, selling, or investing in real estate, please call me, Dennis Smith - REALTOR®, at 760-212-8225.

For more tips about home improvements to sell click here.

Find out what our clients say about us: https://carlsbadhomesforsalenow.com/testimonials/

Knowing when to tackle things yourself or leave the renovation to the experts is one of the most important factors, not only in saving money but also time, when it comes to home renovations.

It’s a proud moment when you see your beautifully renovated home knowing you did all the improvements by yourself. But it’s also bliss when you see immediate results by hiring a professional.

Whether you’re staging your Carlsbad CA home for selling or simply want to give your home a new look, the following home improvement tips I gathered will help you save time, money, or both.

If you have questions regarding buying, selling, or investing in real estate, please call me, Dennis Smith - REALTOR®, at 760-212-8225.

For more tips on home improvements click here:https://carlsbadhomesforsalenow.com/how-to-stage-your-home-to-sell/

Find out what our clients say about us :https://carlsbadhomesforsalenow.com/testimonials/

If you’re thinking of buying a home in Carlsbad, CA, you probably already know just how tight the competition is. Since the start of the coronavirus pandemic, Carlsbad housing prices have gone up 36.1 percent!

While purchasing and owning your first home can be intimidating, you should know that it’s an attainable goal. With the help of tax breaks and first-time homebuyers programs offered by the federal and California state governments, that goal is more attainable than ever!

To qualify as a first-time homebuyer in Carlsbad, CA, you must prove adequate income, good credit rating, obtain a mortgage, and provide a minimum down payment of 3 percent.

To help you out, let’s discuss all the basics of first-time homebuyer requirements in San Diego, California. Before we do that, though, let’s clarify what it means to be a first-time homebuyer.

Let’s get started!

You might be surprised to find out that “first-time home buyer” isn’t as restrictive as you think.

Generally, a first-time homebuyer extends to people who have already bought a home in the past. The catch is that the person should not have owned a home in the past three years to be considered a first-time buyer.

To qualify as a first time home buyer in Carlsbad, CA, you must fulfill these requirements:

Individuals who have owned a principal residence for three years cannot be considered first-time homebuyers.

Aside from having not owned or co-owned a residence in the past three years, you will also need to qualify for a mortgage to be a first-time homebuyer.

A lender will require you to meet a minimum credit score and a maximum debt-to-income ratio to qualify for a mortgage. You will also need to prove financial stability with your monthly income, cash reserves, and employment status.

How much your housing budget is will depend on several factors. Hence, you must determine a price range for your future Carlsbad home before you look for a home and apply for a mortgage.

The median home price for a home in Carlsbad has risen to $1.3 million, which is more than the average buyer can afford in San Diego.

To figure out if buying a home in Carlsbad is right for you and your budget, you should consider:

After figuring out the state of your finances, you can then figure out how much mortgage you can afford.

Thankfully, first-time homebuyers have many options when it comes to purchasing a home. These include Federal Housing Authority loans and programs that specifically target first-time buyers.

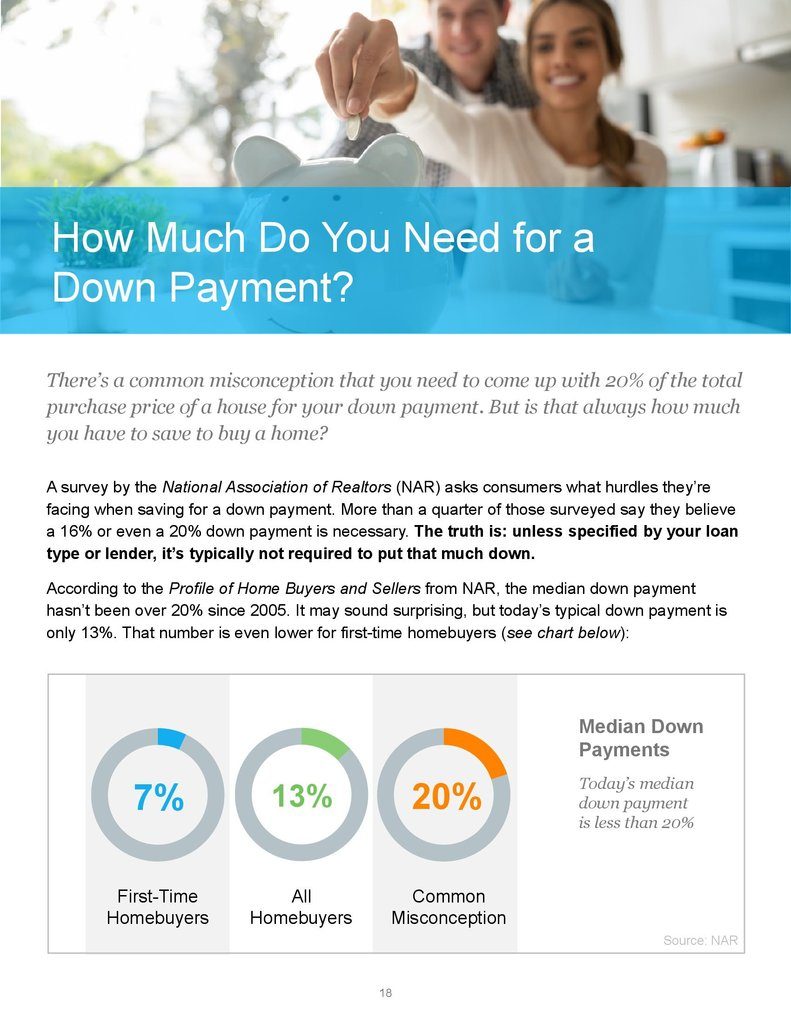

Many first-time buyer loans offer a minimum down payment of as low as 3 percent, opening a world of opportunity to buyers who have only come across the standard 20 percent down payment.

If you qualify as a first-time homebuyer, make sure to look into these mortgage options.

Before I introduce you to some of these loans, remember that qualifying will still depend on the lender (more on that later!):

Before qualifying for mortgage loans, you must determine exactly how much mortgage you are eligible for.

You might have set your eye on a home, but lenders may only be willing to give you a portion of that based on your debt-to-income ratio, monthly income, and current employment status. Lenders will also take into account loan factors:

A general rule of thumb is that lenders estimate mortgage payment affordability (interest, taxes, principal, insurance) to be 28 percent or less than the borrower’s gross monthly income.

In many cases, you won’t be entertained by sellers and even real estate agents if you haven’t been pre-approved for a mortgage.

Generally, Carlsbad, CA homes for sale get 5+ offers and sell in about 12 days. Since competition for Carlsbad homes is high, getting approvals from multiple lenders will show your buyer how financially secure and prepared you are to purchase a home.

Your real estate agent can give you a list of recommendations, or you can consider the options on Bankrate or Zillow.

You will need to provide the paperwork to show your financial stability, including:

Lenders will determine if you are qualified for their loan options based on these factors:

A qualified San Diego real estate agent can help you find a home that meets our needs and budget requirements.

Call me, Dennis Smith of San Diego Senior Real Estate, at 760-212-8225 to assist you in the entire buying process. From negotiating an offer to getting a loan and completing paperwork, I will be happy to be part of your journey in purchasing your first home.

for more information on home buying, click here:https://carlsbadhomesforsalenow.com/wp-admin/post.php?post=58470&action=architect&tve=true

Learn more about what people say about Dennis Smith: https://carlsbadhomesforsalenow.com/testimonials/

Some mistakes in life can be costly, and one example of that are tax filing mistakes. You may incur penalties, or worse, invite an IRS audit.

Mistakes happen unintentionally when filing tax returns, so it's crucial to steer clear of such errors by carefully filling out the forms and taking note of the following mistakes you'll want to avoid:

I hope these simple tips made you feel more confident and prepared for this tax season.

If you also have questions regarding buying, selling, or investing in real estate, please call me, Dennis Smith, at 760-212-8225.

With proper knowledge, filing your tax return can be a breeze this spring!

The pandemic has so many changes, and it may not be as easy to keep up with the new updates for this tax season 2022.

But stress no more because I have created a brief overview of this year’s tax policy highlights. I’m also letting you know that since the production of this piece, the tax deadlines have changed. Please check IRS.gov for the most up-to-date information.

I’ll be happy to help you get a head start on your taxes by answering your questions or connecting you to a skilled professional in my network.

If you also have questions regarding buying, selling, or investing in real estate, please call me, Dennis Smith, at 760-212-8225.

A new year gives a feeling of renewal, and this can extend to your Carlsbad, CA home too. As you start new goals, making your space feel nicer and fresher this 2022 can make the journey more fun.

Whether you want to liven up your home by tackling something as big as a home renovation, or you just like a few changes on the decor arrangement, I hope 2022 will be the year you accomplish all the items on your to-do list.

Here are a few cost-effective and aesthetic ideas you can start with:

For any questions regarding buying, selling, or investing in real estate, please call me, Dennis Smith, at 760-212-8225.

2021 presented both entryways and roadblocks for our opportunities and goals, and thankfully, 2022 brings a fresh focus.

If part of your goal is making some real estate plans come true this year, you’ve come to the right place because I’m here to bring some insightful snapshots when it comes to the 2022 housing market.

The information I’ve included this month will provide real estate market predictions to keep an eye on as the year progresses. I’ve also included a helpful guideline to use when choosing the right neighborhood if you or someone you know is considering a move.

For any questions about this year’s housing outlook, I will be happy to assist. Please call me, Dennis Smith, at 760-212-8225.

I’ll be glad to take care of your real estate concerns in a way that’s healthy and safe.

Click here to get to know Dennis and Sunshine Smith.

You can also contact us through this link: https://carlsbadhomesforsalenow.com/contact/

Getting started is always the most challenging part for almost any task, and journaling is not an exception. It's nice to welcome the new year in writing, but it won't be easy if you have no idea what to write.

If you have been racking your brain for topics but to no avail, no worries because I've got you covered. Here are some writing prompts you can use:

For more information or assistance in buying, selling, or investing in real estate, please call me, Dennis Smith at 760-212-8225. I’ll be glad to take care of your real estate concerns in a way that’s healthy and safe.